HYPE has posted its third-largest weekly net outflow on record, signaling rising pressure in the decentralized perpetual derivatives landscape.

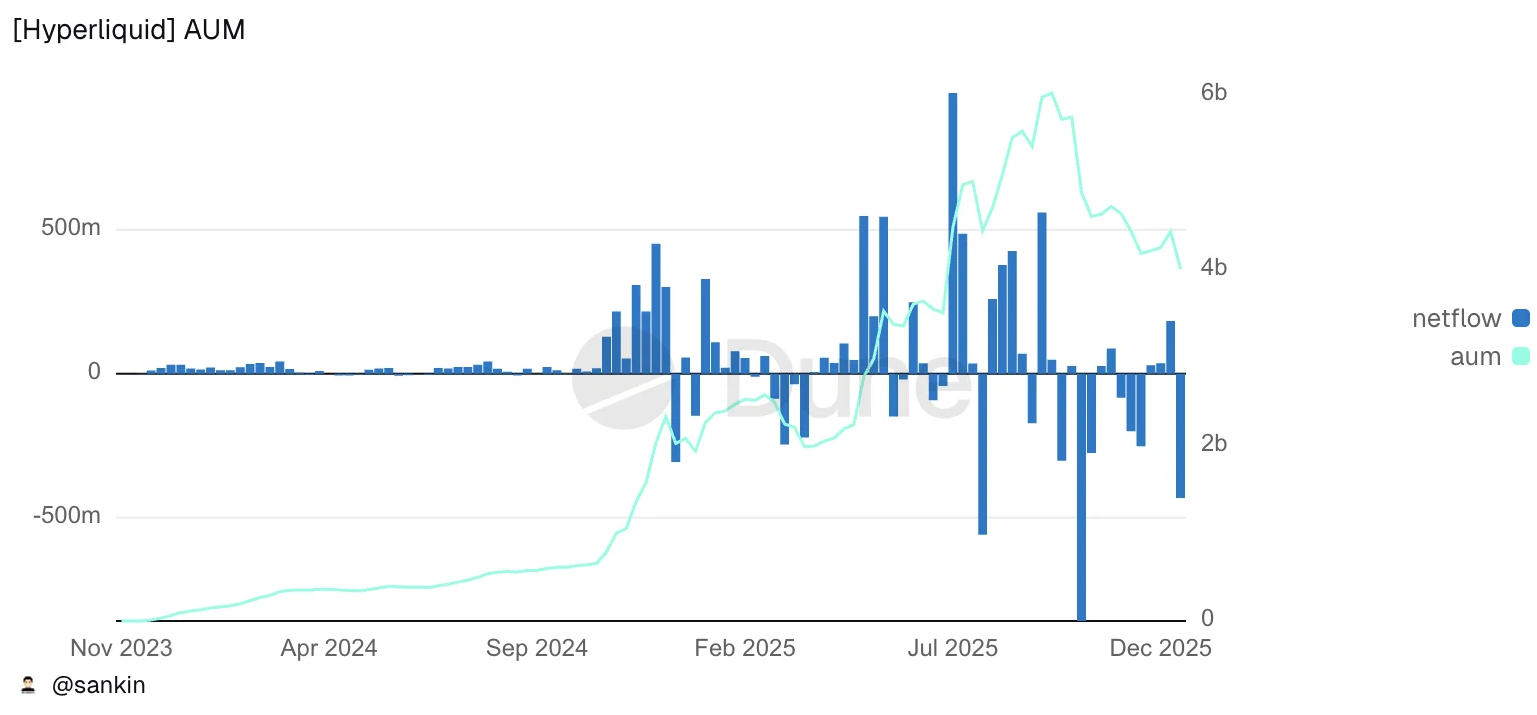

Data from a Dune Analytics dashboard compiled by sankin_eth shows that more than $430 million exited Hyperliquid over the past seven days. This capital flight coincides with a sharp contraction in assets under management, as total value locked (TVL) declined from over $6 billion in mid-September to approximately $4 billion.

At the same time, HYPE’s native token dropped nearly 20% over the past week, mirroring a broader market pullback, according to PRIME’s pricing data.

Although onchain metrics do not directly explain trader intent, capital rotation appears closely tied to intensifying competition among perpetual DEX platforms.

Newer challengers such as Lighter and Aster have climbed rapidly in perp DEX trading volume rankings, eroding Hyperliquid’s once-dominant lead in decentralized derivatives.

Despite the recent withdrawals, Hyperliquid remains one of the largest perpetual DEXs by volume and open interest, though the gap separating it from competitors has narrowed significantly compared to earlier this year.

Lighter Gains Momentum on Airdrop Speculation

Lighter has emerged as one of the fastest-growing challengers, supported by a points-based rewards program that many traders believe could precede an airdrop or token generation event (TGE).

A Polymarket contract with nearly $8 million in volume currently implies a roughly 72% probability that Lighter launches a TGE by December 31. Speculation accelerated this week after onchain analysts from Double Top flagged what appeared to be the first movement of $LIT tokens to a Coinbase-linked wallet, a pattern previously observed ahead of other token launches.

Lighter is backed by major investors including Founders Fund and Ribbit Capital, further reinforcing confidence among traders positioning early.

Aster’s Rapid Rise — and Ongoing Controversy

Aster’s ascent has been equally notable but far more volatile. In September, the rebranded protocol surged into direct competition with Hyperliquid after receiving a public endorsement from Binance co-founder Changpeng “CZ” Zhao.

Shortly thereafter, Aster briefly claimed the top spot among perpetual DEXs by daily fees and trading volume. However, momentum stalled following controversy.

The protocol’s token fell around 10% after DefiLlama’s founder alleged potential wash trading, prompting the data platform to remove Aster’s perpetuals metrics. Soon after, YZi Labs-backed Aster postponed its Stage 2 airdrop, citing “potential data inconsistencies.”

Despite these setbacks, Aster continues to rank among the most active perpetual DEXs, maintaining strong user engagement.

Hyperliquid Still Leads — But the Gap Is Closing

Even after the recent outflows, Hyperliquid continues to command a leading market share in decentralized perpetual trading. However, PRIME’s data shows that both Lighter and Aster have captured meaningful portions of trading activity in recent months.

While Hyperliquid remains ahead, its dominance is no longer as pronounced, suggesting a more competitive and fragmented perp DEX market moving forward.

Venture Capital Bets Grow on Decentralized Derivatives

As competition intensifies, venture capital interest in decentralized derivatives infrastructure has strengthened.

Investors increasingly view perpetual trading as one of crypto’s most resilient product categories, given its relatively lower dependence on retail cycles.

Recent examples highlight this trend:

-

Lighter raised $68 million at a $1.5 billion valuation in November

-

Ostium secured $24 million to expand its real-world asset perpetuals platform

Backers cite the shift toward onchain execution, custom-built trading environments, and the ability to scale rapidly through incentives and innovation as key drivers behind renewed investment in perp DEX platforms.