According to onchain analytics firm CryptoQuant, the crypto market has already entered a bear market phase, driven primarily by a clear slowdown in Bitcoin demand growth.

In a report released Friday, CryptoQuant stated that BTC demand growth has dropped below its long-term trend, marking a decisive shift in market structure. The firm noted that three major demand surges since 2023 — triggered by the U.S. spot Bitcoin ETF launch, the U.S. presidential election outcome, and the Bitcoin treasury company boom — have now fully played out.

As a result, most incremental demand from the current cycle appears to have been absorbed, removing a critical pillar of price support for Bitcoin.

Based on current conditions, CryptoQuant sees elevated downside risk for Bitcoin, with $70,000 identified as a key intermediate support level.

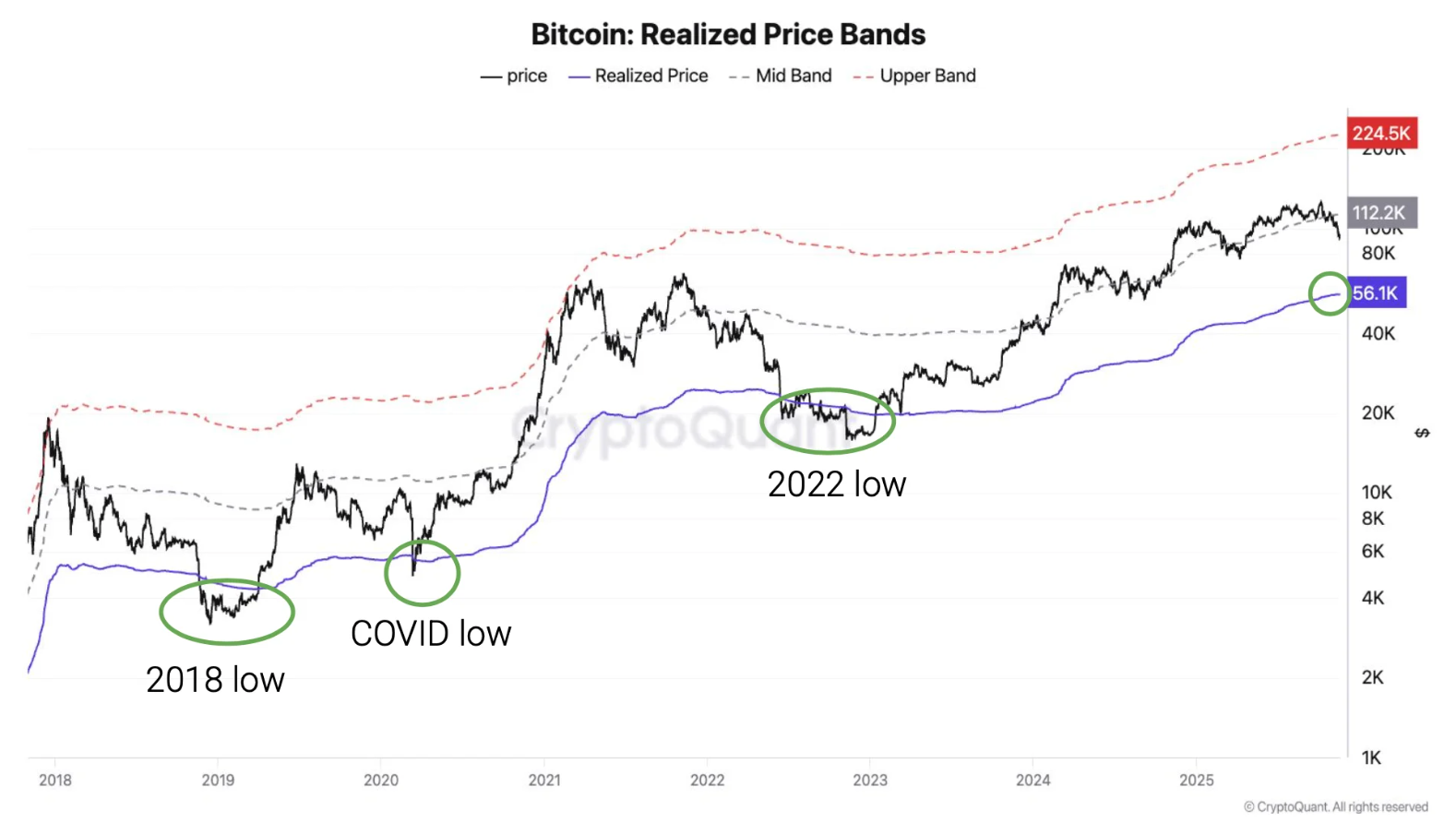

If momentum continues to deteriorate, the firm warns that Bitcoin could eventually retest the $56,000 zone, a level closely aligned with the realized price, which has historically coincided with cycle bottoms.

CryptoQuant emphasized that even such a move would represent a relatively mild bear market by historical standards, implying a roughly 55% drawdown from the most recent all-time high, the smallest peak-to-trough decline seen in prior cycles.

Timeline: Months for $70K, Longer-Term Risk for $56K

Speaking to PRIME, CryptoQuant Head of Research Julio Moreno said a move toward $70,000 could materialize within the next three to six months, while $56,000 remains a longer-horizon scenario.

Moreno added that the bear market effectively began in mid-November, shortly after the largest liquidation event in crypto history on Oct. 10, which marked a structural turning point for demand.

Should selling pressure persist, a deeper decline toward realized price would more likely occur in the second half of 2026, he said.

ETF Flows and Onchain Metrics Confirm Demand Erosion

CryptoQuant highlighted a sharp reversal in U.S. spot Bitcoin ETF behavior as another warning sign. During the fourth quarter of 2025, ETFs became net sellers, shedding approximately 24,000 BTC, a stark contrast to the heavy accumulation seen during the same period a year earlier.

Additionally, addresses holding between 100 and 1,000 BTC — a group that includes ETFs and Bitcoin treasury firms — are now expanding below historical growth trends, mirroring patterns observed in late 2021 ahead of the 2022 bear market.

Derivatives Markets Reflect Declining Risk Appetite

Signals from derivatives markets further reinforce the bearish narrative.

CryptoQuant reported that perpetual futures funding rates, measured on a 365-day moving average, have fallen to their lowest levels since December 2023. Historically, declining funding rates indicate reduced willingness to maintain leveraged long positions, a hallmark of bear market conditions rather than bull phases.

Bitcoin has also fallen below its 365-day moving average, a long-term technical threshold that has traditionally separated bull and bear market regimes.

Demand Cycles — Not Halvings — Drive Bitcoin’s Market Structure

CryptoQuant reiterated its long-standing thesis that Bitcoin’s four-year cycles are driven by demand expansions and contractions, not by the halving event itself.

“When demand growth peaks and rolls over, bear markets tend to follow — regardless of supply-side dynamics,” the firm said, emphasizing that halvings do not override weakening demand trends.

Bearish Outlook Contrasts With Bullish Bank Forecasts

At the time of writing, Bitcoin is trading near $87,800, up roughly 3% over the past 24 hours, according to PRIME’s price data.

CryptoQuant’s caution stands in contrast to more optimistic forecasts from major financial institutions. Citigroup reportedly projects a base-case target of $143,000 over the next 12 months, with a bull scenario reaching $189,000, while still acknowledging $70,000 as a critical support zone.

Standard Chartered has recently taken a more conservative stance, cutting its 2026 Bitcoin target to $150,000, while JPMorgan continues to see upside toward $170,000 over the next 6–12 months, citing Bitcoin’s volatility-adjusted comparison to gold. Meanwhile, Bitwise maintains that Bitcoin is likely to print new all-time highs in 2026.