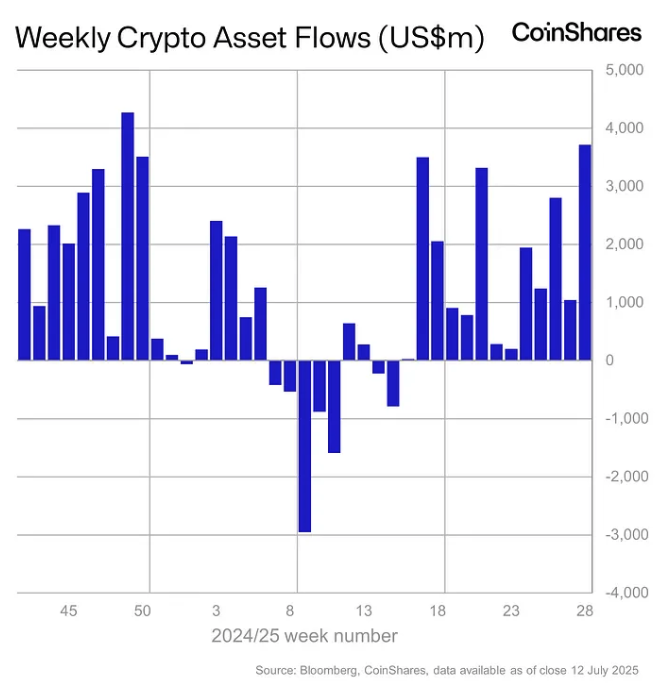

Global crypto funds, including those managed by BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, amassed a total of $3.7 billion in net inflows last week, according to fresh data from CoinShares.

This figure marks the second-highest weekly inflow on record, just behind the $3.9 billion surge seen in early December. With Bitcoin setting new all-time highs, total assets under management (AUM) in these funds have now climbed past $211 billion, setting a new milestone, said James Butterfill, CoinShares’ Head of Research.

“July 10 ranked as the third-highest single-day inflow in crypto fund history,” Butterfill added in Monday’s report.

Crypto Funds: 13 Weeks of Consistent Growth Drive YTD Inflows to $22.7B

The inflow streak now stretches to 13 consecutive weeks, with $21.8 billion in total net additions over that period. Year-to-date inflows have reached a new record of $22.7 billion, while weekly trading volumes doubled the 2024 average, hitting $29 billion last week.

Bitcoin and Ethereum Lead, U.S. Funds Dominate Global Activity

The United States led regional inflows with $3.7 billion, followed by Switzerland ($65.8 million) and Canada ($17.1 million). However, Germany, Sweden, and Brazil saw combined outflows of nearly $109 million, partially offsetting global growth.

Bitcoin-based products pulled in $2.7 billion, representing 73% of all inflows and raising their AUM to $179.5 billion. For the first time, Bitcoin ETFs now match 54% of the gold ETP market in terms of asset value, Butterfill noted. In contrast, short Bitcoin positions saw minimal activity last week.

U.S. spot Bitcoin ETFs accounted for the bulk of these gains, drawing $2.72 billion alone, according to data from PRIME.

Ethereum Inflows Hit Fourth-Highest Weekly Record

Ethereum-focused funds added $990 million—the fourth-largest weekly total on record—marking their 12th consecutive week of inflows, the longest streak since mid-2021.

“Ethereum’s recent inflows represent 19.5% of its AUM over the past 12 weeks, compared to 9.8% for Bitcoin,” Butterfill explained.

The majority of these flows came from U.S. spot Ethereum ETFs, which attracted $908.1 million last week.

Altcoin Trends: Solana Sees Gains, XRP Suffers Losses

Among altcoins, Solana investment products saw the highest net inflows at $92.6 million, while XRP funds recorded outflows of $104 million, making it the worst-performing crypto investment product last week in terms of capital movement.